Pepperstone is Australia’s second largest broker, and the 9th biggest globally with a daily trade volume of 5.9 Billion USD. In the past two years, the company has been increasing its market share by expanding into the Asian market. This has meant that the company increased by 3% in the past year alone.

From is offices in Melbourne, the company which is regulated by the Australian Financial Services has to maintain capital requirements, staff training, comply with risk management processes, audits and accounting.

Client support

Pepperstone won the Investment Trends overall client satisfaction award plus the customer awards in 2015 and in 2016 for a reason, its attention to customer support. As part of the company’s support, it offers:

• Personalized customer service. The company’s staff has extensive Forex experience that they share with customers of different levels. In addition, the company provides access to account managers which are assigned to a trader to provide a better grasp of the trader’s needs.

• 24/5 hour support. With offices in Melbourne, Shanghai, Bangkok, Dallas and London, the company offers support when the markets are open.

• Contact channels. To cement their support, Pepperstone offers live chat on a 24 hour phone, as well as email support to clients.

• They also have a Pepperstone YouTube channel, as well as the online Pepperstone resource center

• They also offer a demo account service, in MT4 platform for clients.

Fast execution trading speeds

Pepperstone is an ECN broker, which implies that fore trading can be done without dealer intervention with the assistance of their Razor account. The benefit for traders are that they have direct access to liquidity currency pools, which includes financial institutions internationally.

The execution speeds are also enhanced by up to 12x with the aid of fast global trading servers (through its partnership with Equinix, a NASDAQ listed firm), and fiber optical connections from their head office to Wall Street.

MetaTrader and cTrader Forex platform options.

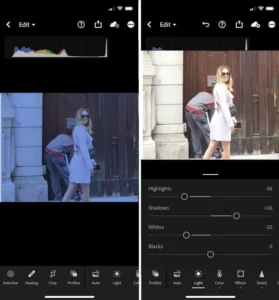

Based on trading style, Pepperstone offers two platforms, namely:

• MetaTrader forex which is user-friendly, and to order management tools. It is also the most preferred Forex platform globally, which allows for real-time charts, in-depth news and live quotes.

• cTrader allows for direct access to inter-bank market depth and to use algorithmic based Forex trading systems. Plus, the interface can be personalized, and there is a large back testing facilities.

Market leading leverage levels of 500:1

500:1 implies that for each of dollar deposited to Pepperstone’s online account, the broker will match it up to $500. Generally, high leverage equals high risk.

Low spreads through an ECN Forex trading environment

Pepperstone’s Edge Standard account demands no commission, and the spread begins from 1.0pips. This account is aimed at normal traders and uses Institutional Grade STP Spreads. Their Edge Razor account, aimed at advanced traders, has an AU$3.5 commission on every $100k traded with spread from 0.1pips. Still, the minimum deposit size is $ 200 for the Razor account, and for their standard account, payment options range from BPay, credit cards to even PayPal. Just, US traders are not allow to open accounts with them.

Other accounts available are the Active traders and the Swap Free accounts. The Active Traders account, aimed at high level traders, provides clients’ access to a private relationship manager, but it charges a commission fee of 3.5%. The Swap free account is aimed at the Muslim market, and is Sharia complaint. This account attracts a 0% commission rate.